Blog Post from December 01, 2022 by Bart DeCanne

OptionAgent Launch & Initial Results

OptionAgent Launch & Initial Results after 2 Months

Welcome to OptionAgent (OA)!

The launch of the OA hedge fund has been more than 2.5 years in the making, since the early days of the pandemic in April 2020 (read about our story). So I won’t dwell on the past here. But I’m delighted to finally launch the option strategy that was developed since then into a full-fledged hedge fund.

The fund actually started trading on October 1 2022. Today 2 months later, we launch the fund publicly after obtaining performance results of the first 2 months - results tabulated and verified by an independent 3rd party fund administrator who also provides the monthly statements to each investor.

As OA aims to provide an alternative to traditional stock investing, the past 2 months have been atypical vs what has transpired in the market since the start of 2022. The market actually reached a low on September 30, just before we started trading, and has since seen a 14% cumulative gain during October and November. The OA investment strategy particularly shines during times of stagnant or slightly down markets; that’s when our market outperformance is expected to be highest. This is because we are volatility-based, so we are monetizing changes in the market, whether they are up OR down.

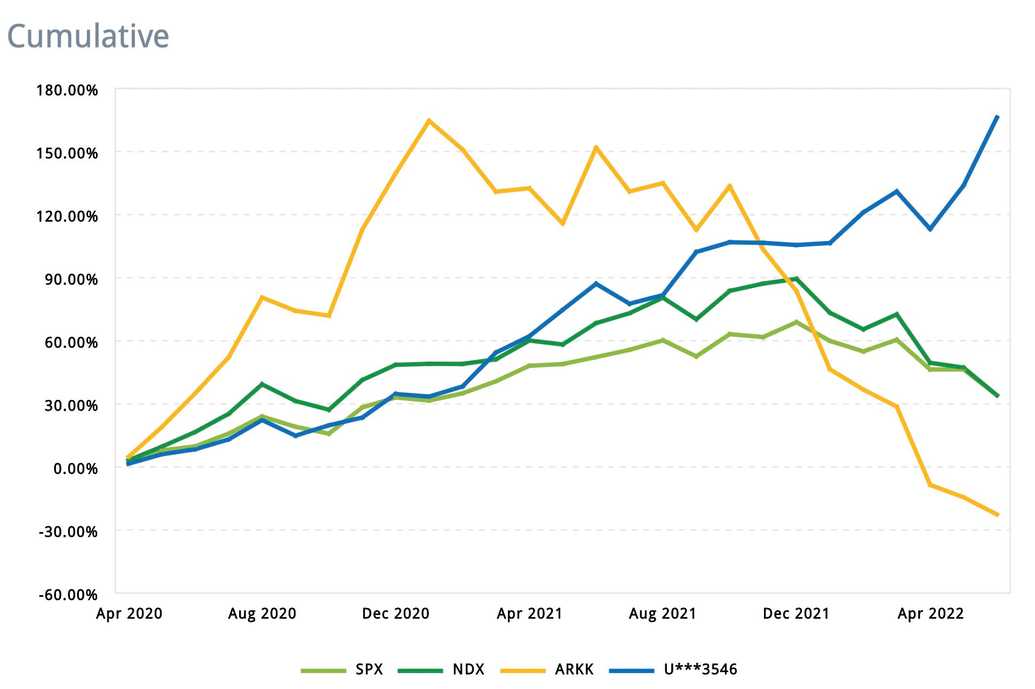

The OA fund replicates an investment strategy used in a personal account from April 2020 until end of June 2022. So while the fund is new, we do have a 2.5 year history to show. Although not audited since a personal account (and we cannot legally claim it is in any way representative of our fund performance), it does provide some interesting insight. As you can see on the graph below, we had a return that equaled the market return of about 60% during the first 12 months. Then as the market peaked, became stagnant, and later started its significant decline from late 2021, we started outperforming from Q3 2021, and accumulating ever more until end of Q2 2022 (benchmarks shown are S&P500, Nasdaq-100 and ARK Innovation ETF).

Did we find alpha? Time will tell over the next months as the fund gathers additional monthly performance numbers. Unlike many hedge funds our goal is to be 100% transparent about our results and update the home page around the first of each month with the latest monthly results. With some of the market pundits expecting a roughly flat S&P500 between now and end of 2023 (albeit with lots of expected volatility in between we aim to monetize...), the future for OA may just be bright!

And of course, if you’re an Accredited Investor, we hope you will reach out to consider joining us on this journey.

Tagged in: