Blog Post from April 10, 2023 by Bart DeCanne

Risk-adjusted Returns of the Fund's First 6 Months

Risk-adjusted Returns of the Fund's First 6 Months

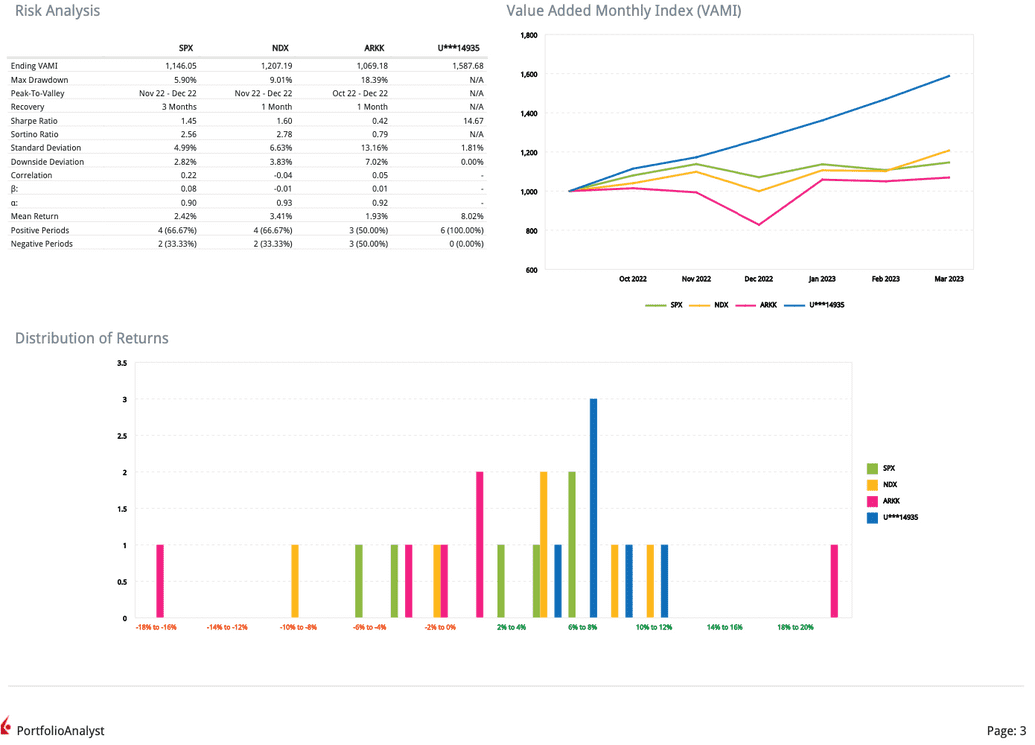

The OptionAgent fund started trading on Monday Oct 3 2022. With now 6 months of history, it’s a good time to look at our returns from October 2022 through end of March 2023. Besides just the raw cumulative return over these 6 months (55%), savvy investors know to pay attention to risk-adjusted return measures. Intuitively an investment that doubles (100% return) over a time horizon, but within that timeframe fluctuates heavily in NAV (net asset value), is more risky than one that offers a consistent month-to-month positive return to eventually result in a 100% cumulative return.

Secondly in these times of uncertainty, with higher inflation and a volatile stock market, investors look for any investment that offers a true low correlation with the stock market, to offer downside protection to their portfolio. While traditionally bonds have played that role in a 60% equity / 40% fixed income portfolio, outstanding bonds that are not necessarily kept until maturity no longer offer that safety net in an inflationary environment as their spot prices need to decline to offer a market-competitive yield in any secondary market. Thus now bonds actually become positively correlated with the stock market as well (which of course also typically declines as interest rates rise).

So let’s look at some actual risk-adjusted return measures of the OptionAgent over these 6 months.

We use for this the PortfolioAnalyst (PA) report generation tool from Interactive Brokers LLC, the fund’s custodian. Contrary to managed accounts offered by an investment advisor, our hedge fund uses a single pooled investment brokerage account for all its trading. This ensures every investor in the fund receives the same returns on their investment. It also means we can pull the PA report from this single account to reflect the overall fund. PA is independently certified as a GIPS-compliant reporting tool.

A small caveat with these numbers: they reflect over 99% of the fund’s assets which are held in the brokerage account. A very small remainder is held in a zero-interest bank checking account from which day-to-day fund expenses are paid. Thus the numbers shown here are slightly higher than the official fund returns reported by the 3rd party fund administrator (which would also include the fund assets held in the bank account in the fund’s NAV) but differences are minor: e.g. while the official cumulative return of the fund over these 6 months is 55%, PA will report it as 58%. As such all risk-adjusted measures shown will be fractionally higher as well but with only a minimal difference. We still elect to show the PA-reported numbers here instead of our own calculations for the overall fund assets since it’s from a certified and trusted tool.

Sharpe ratio

A widely used risk-adjusted return measure is the Sharpe ratio. It is defined as the return in excess of the risk-free rate, divided by the standard deviation of returns over each reporting interval (the reporting interval is 1 month in this case). A more consistent return in each interval will thus lead to a higher Sharpe ratio. A negative Sharpe ratio indicates a negative return. A Sharpe ratio less than one indicates that the return in excess of the risk-free ratio is outweighed by the variation in monthly returns. So any Sharpe ratio higher than 1 is good; higher than 2 is generally considered excellent. The fund had an off-the-charts Sharpe ratio of 14.67.

NAV decline & recovery measures

Next are a set of measures that indicate the peak to bottom variations (’max drawdown’, ‘peak-to-valley’) and how long it takes to recover from a bottom (’recovery’). As there was no month with negative return yet (also shown as a ‘downside deviation’ of 0%), these measures show as ‘N/A’ for the fund.

Sortino ratio

Instead of penalizing a risk-adjusted return measure for any variation in monthly returns, as is done in the Sharpe ratio because it uses the standard deviation of returns, it makes sense to only include negative excursions from the mean monthly return (the earlier ‘downside deviation’). This is how the Sortino ratio improves upon Sharpe ratio. The fund reported a Sortino ratio of N/A (it would be infinite as zero downside deviation results in a zero denominator).

Correlation, alpha, beta

Now let’s look at correlations to various market benchmarks. We show correlation, alpha and beta measures with respect to each of three benchmarks: S&P500, NASDAQ-100 and ARK-K Innovation ETF. The results are shown in the column of each benchmark. Beta is a measure of risk of the portfolio with respect to a market benchmark. Portfolio beta could be increased or decreased by combining assets with different beta values to arrive at a desired overall risk. As you can see the fund has a very low, even negative, correlation to the various market benchmarks, as well as low beta. This means it offers an excellent addition to any investment portfolio to lower portfolio beta while probably also increasing total portfolio return at the same time.

Alpha can be interpreted as the excess return above any return justified from the risk taken. Any positive value is good. Alpha is a proxy for the performance of the portfolio (or in this case: hedge fund) manager. The fund had an alpha of almost 1 with respect to the three benchmarks.

Other measures

The mean, or average, monthly return of the fund was 8% vs 1.9-3.4% for the benchmarks, and had a standard deviation in monthly returns of only 1.8%.

Finally we look at a very simple measure of positive and negative periods. Basically the fund had no negative month, so 6 out of 6, while the benchmarks had 3 or 4 positive months.

Conclusion

Whether gauged by raw cumulative return or any risk-adjusted measure, the OptionAgent fund performance has been spectacular in the first 6 months since its inception, especially since this also was a period marked by multiple Fed interest rate increases and short-term market volatility. While the usual caveat applies (past performance is not necessarily indicative of future results) we believe it does put us in pole position for the future as we continue to fine-tune and improve our algorithmic trading.

Tagged in: